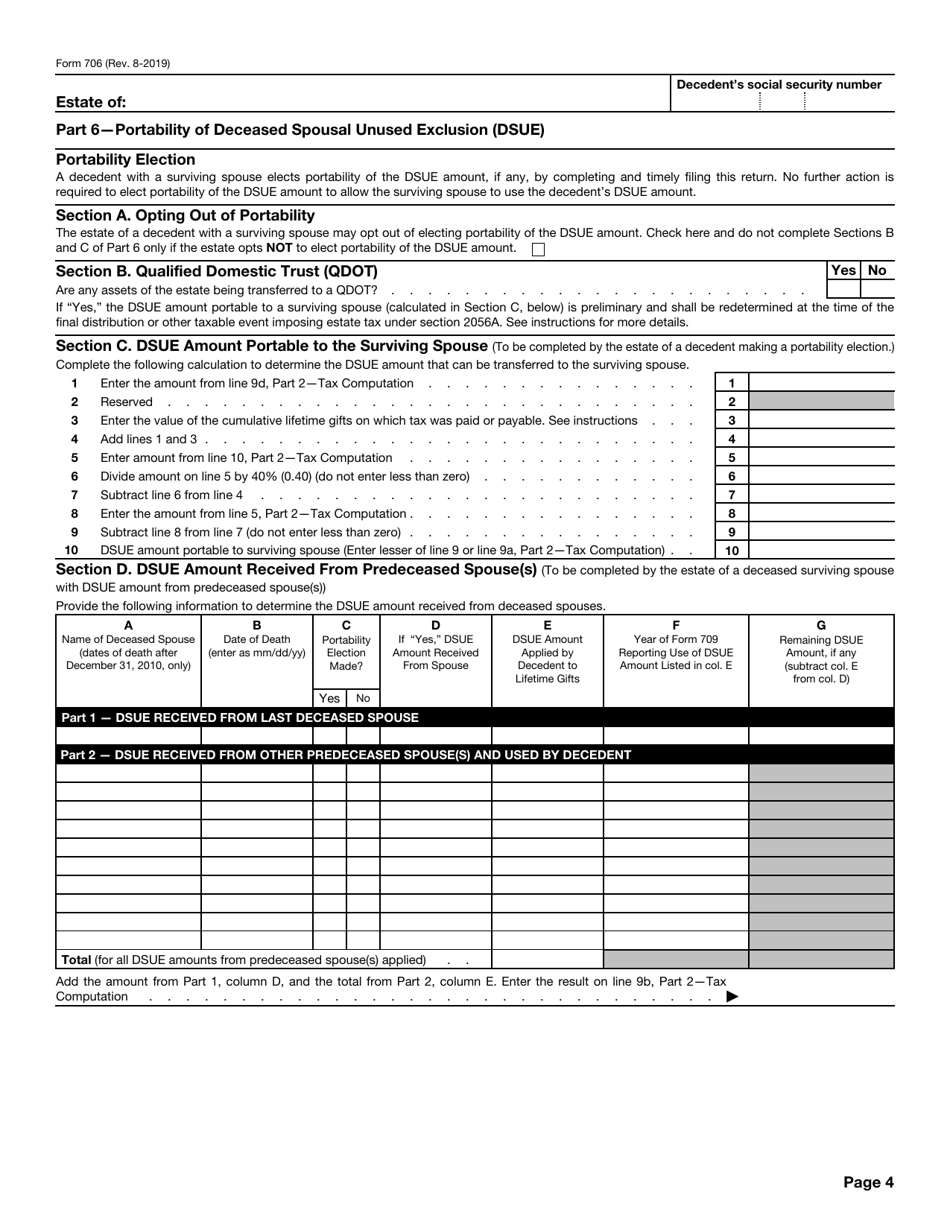

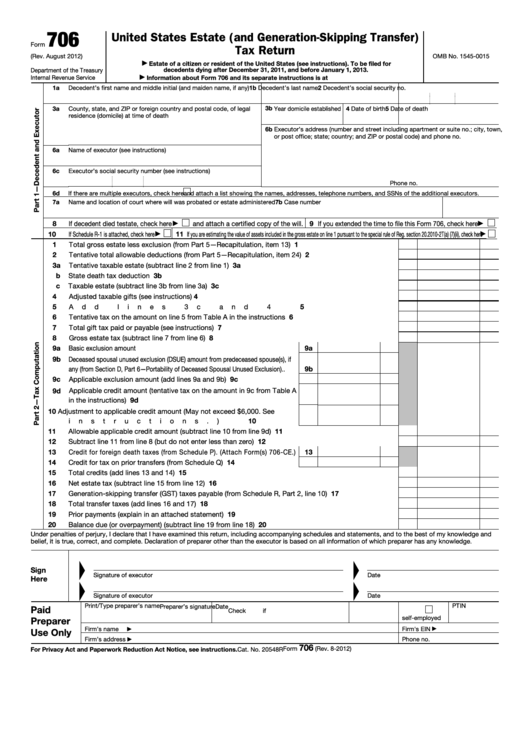

When it comes to estate taxes, the 706 Tax Form is an important document that must be filed by the executor of an estate. This form is used to report the value of the estate and calculate any taxes owed to the IRS. It is crucial to understand the 706 Tax Form to ensure compliance with tax laws and avoid penalties.

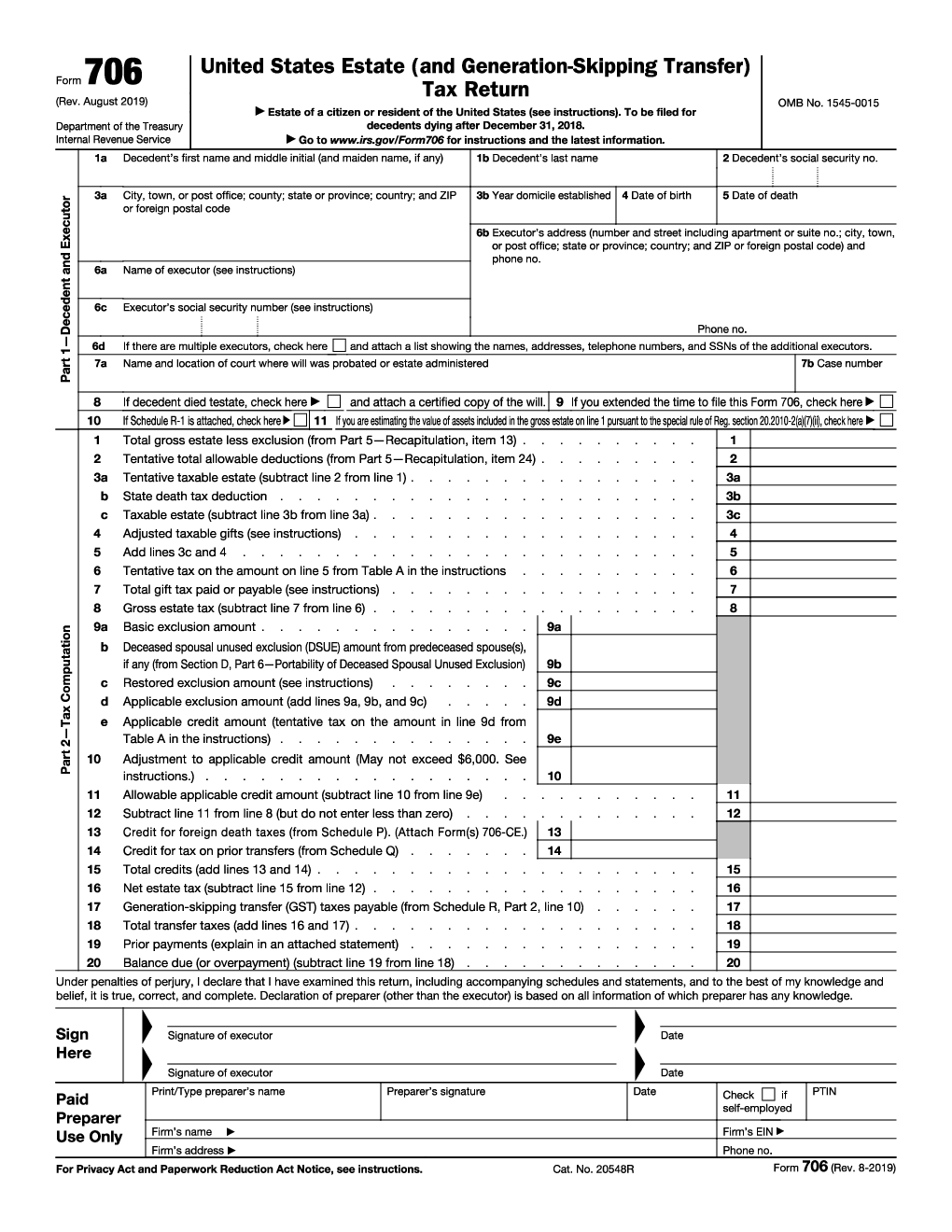

The 706 Tax Form, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the value of an estate and calculate any estate taxes owed. This form must be filed by the executor of an estate if the total value of the estate exceeds the estate tax exemption amount set by the IRS.

706 Tax Form

Searching for an practical way to manage paperwork? A printable form is a reliable tool for both individual and business use. Whether you’re handling job applications, medical records, billing forms, or consent forms, free printable form help streamline the process with convenience.

A printable form allows you to complete important information by hand or on a computer before printing. It’s ideal for workplaces, schools, and remote work where documentation needs to be organized, consistent, and immediately usable.

Quickly Access and Print 706 Tax Form

You can instantly find complimentary, customizable templates online in formats like PDF no technical experience or apps required. Just get, fill in, and use as many copies as needed.

Take control of your routine processes and avoid wasted time. Choose a versatile free printable form today and stay organized, productive, and in control—whether at home or at the office.

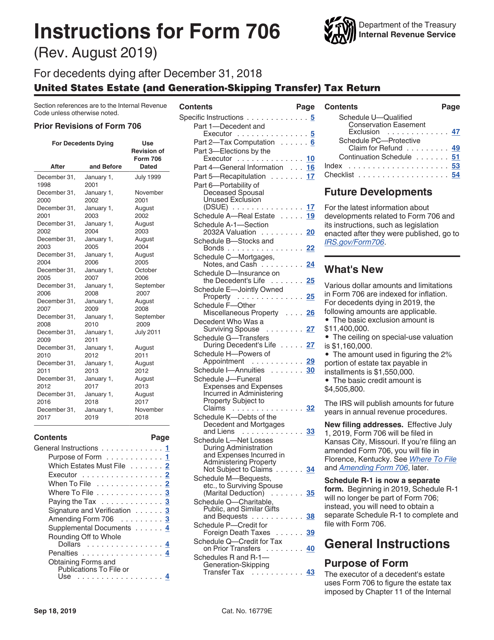

Download Instructions For IRS Form 706 United States Estate And

Download Instructions For IRS Form 706 United States Estate And

IRS Form 706 Download Fillable PDF Or Fill Online United States Estate

IRS Form 706 Download Fillable PDF Or Fill Online United States Estate

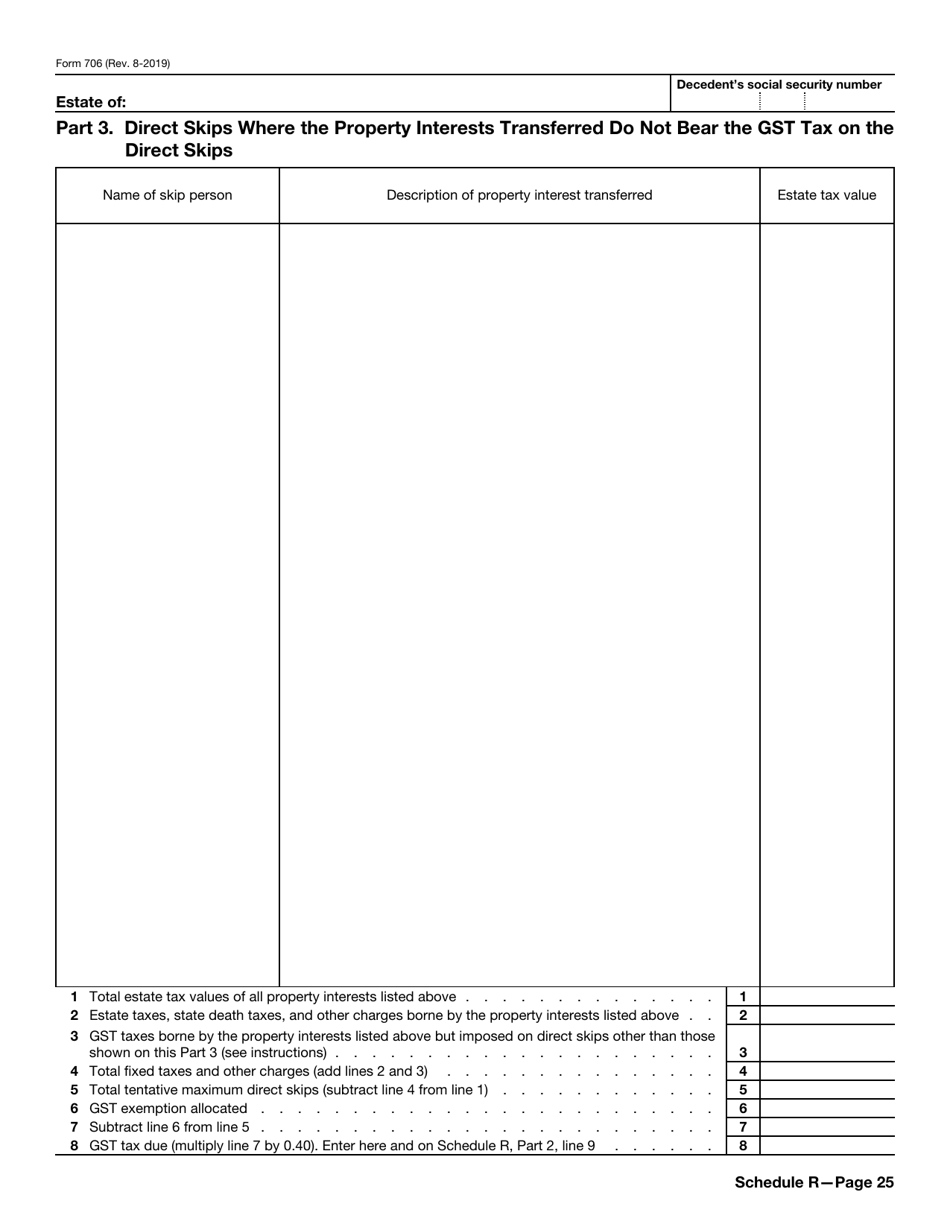

IRS Form 706 United States Estate And Generation Skipping Transfer

IRS Form 706 United States Estate And Generation Skipping Transfer

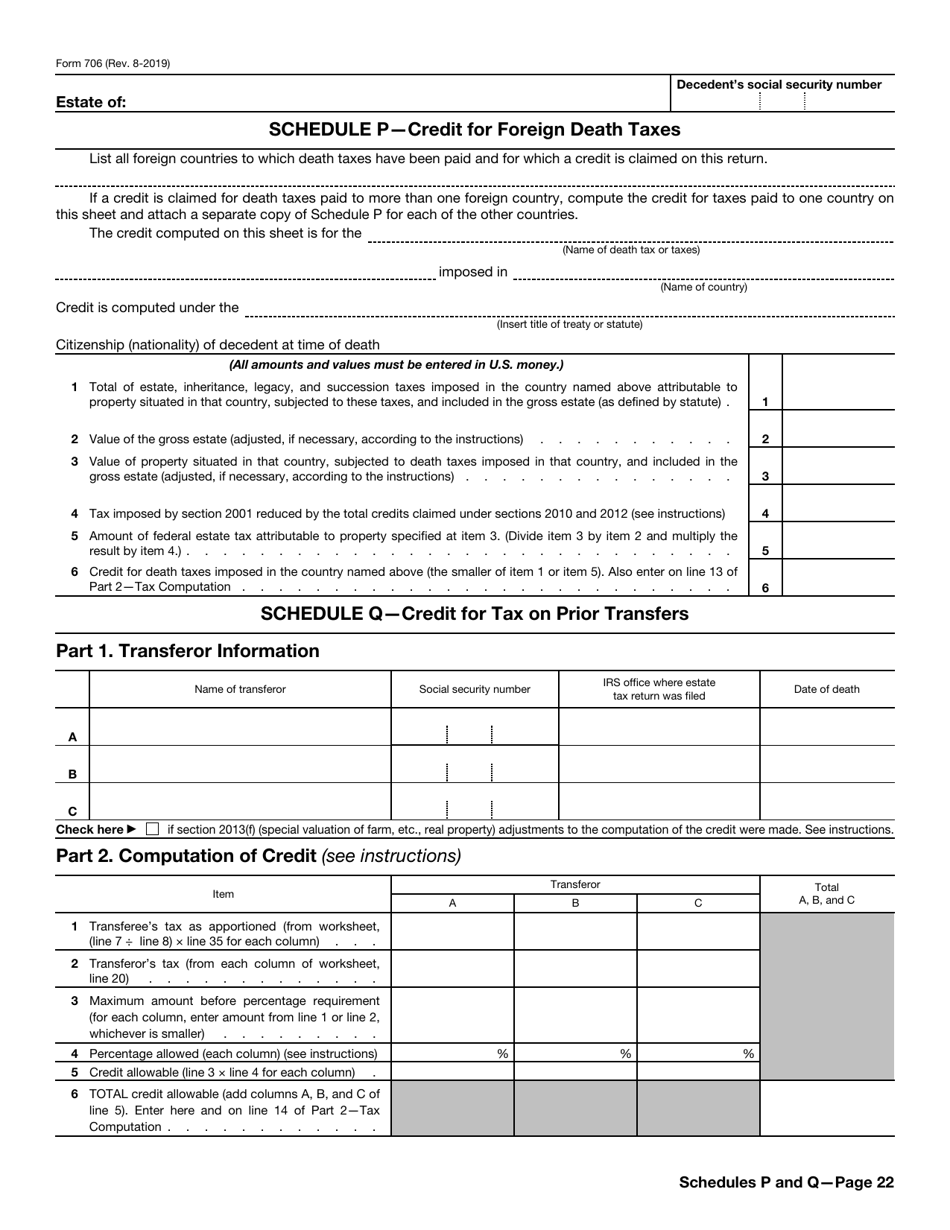

IRS Form 706 Download Fillable PDF Or Fill Online United States Estate

IRS Form 706 Download Fillable PDF Or Fill Online United States Estate

Fillable Form 706 United States Estate And Generation Skipping

Fillable Form 706 United States Estate And Generation Skipping

When filling out the 706 Tax Form, the executor must provide detailed information about the assets and liabilities of the estate, including real estate, investments, and personal property. The value of these assets is used to calculate the estate tax owed, which is based on the total value of the estate minus any allowable deductions and exemptions.

It is important to note that the rules and regulations surrounding estate taxes and the 706 Tax Form can be complex and subject to change. Working with a tax professional or estate planning attorney can help ensure that the form is filled out accurately and that any tax liabilities are minimized.

In conclusion, the 706 Tax Form is a critical document that must be filed by the executor of an estate to report the value of the estate and calculate any estate taxes owed. Understanding the requirements and complexities of this form is essential for proper estate tax planning and compliance with IRS regulations.