Colorado residents are required to file state income taxes annually. The state tax form is used to report income, deductions, and credits to determine the amount of tax owed. This form is essential for residents to comply with state tax laws and avoid penalties.

Filing state taxes can be a daunting task, but with the right information and resources, it can be manageable. Understanding the Colorado State Tax Form is crucial to ensure accurate reporting and timely submission.

Colorado State Tax Form

Looking for an practical way to manage paperwork? A free printable form is a smart solution for both individual and professional use. Whether you’re handling job applications, medical records, invoices, or permission slips, printable form help save time with ease.

A printable forms allows you to enter important information manually or digitally before printing. It’s perfect for offices, schools, and remote work where documentation needs to be organized, consistent, and immediately usable.

Save and Print Colorado State Tax Form

You can quickly find free, editable templates online in formats like Jpeg no design skills or software required. Just get, fill in, and print as many copies as needed.

Begin streamlining your form-filling needs and avoid unnecessary delays. Choose a versatile form printable today and stay efficient, focused, and in charge—whether at your house or at work.

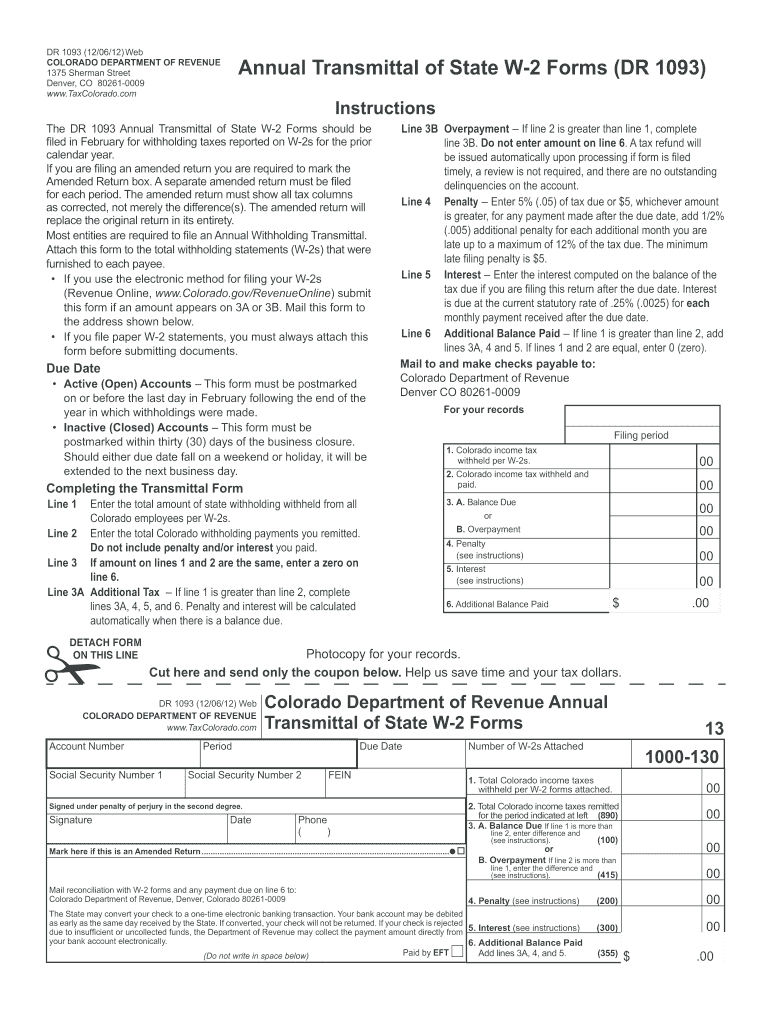

Fillable Colorado Withholding Form Printable Forms Free Online

Fillable Colorado Withholding Form Printable Forms Free Online

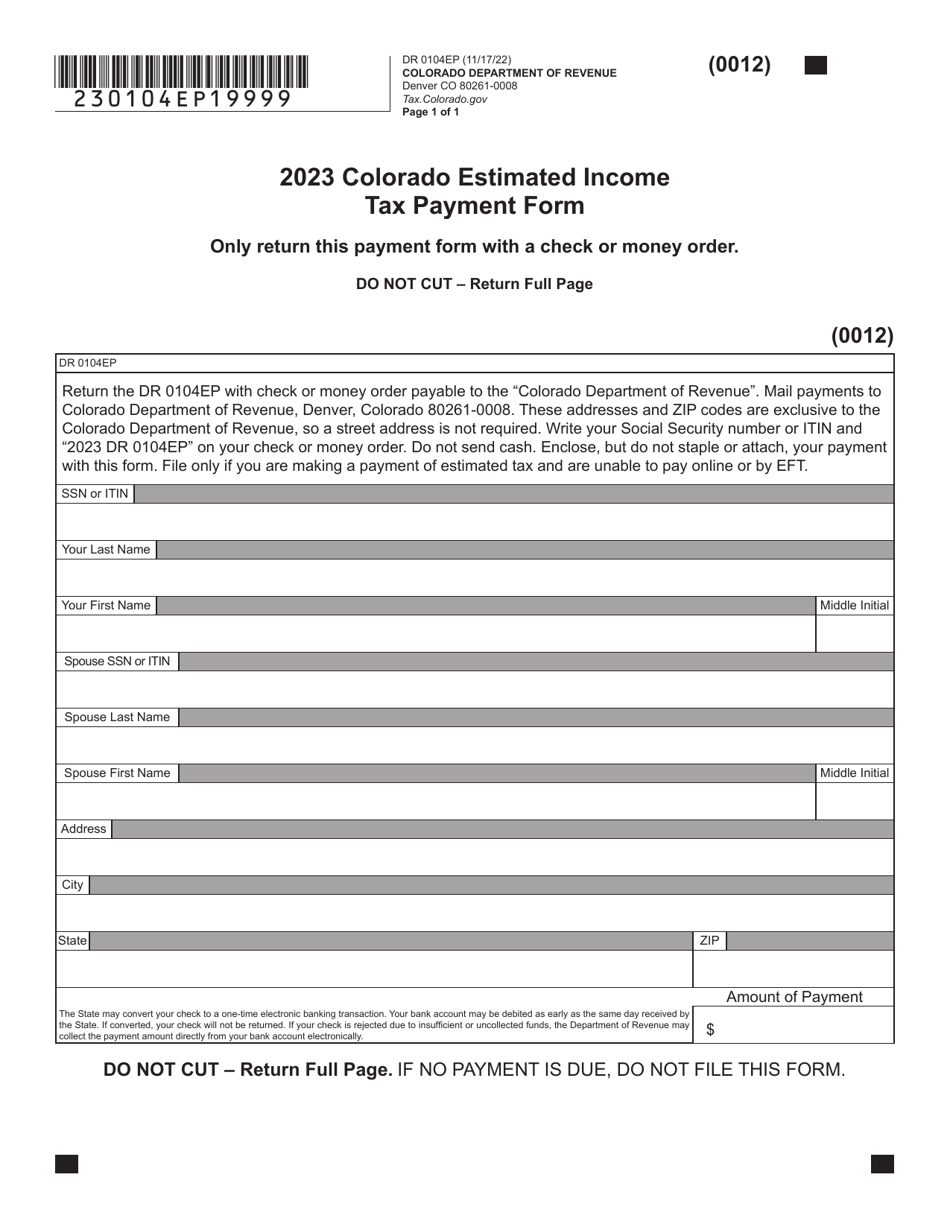

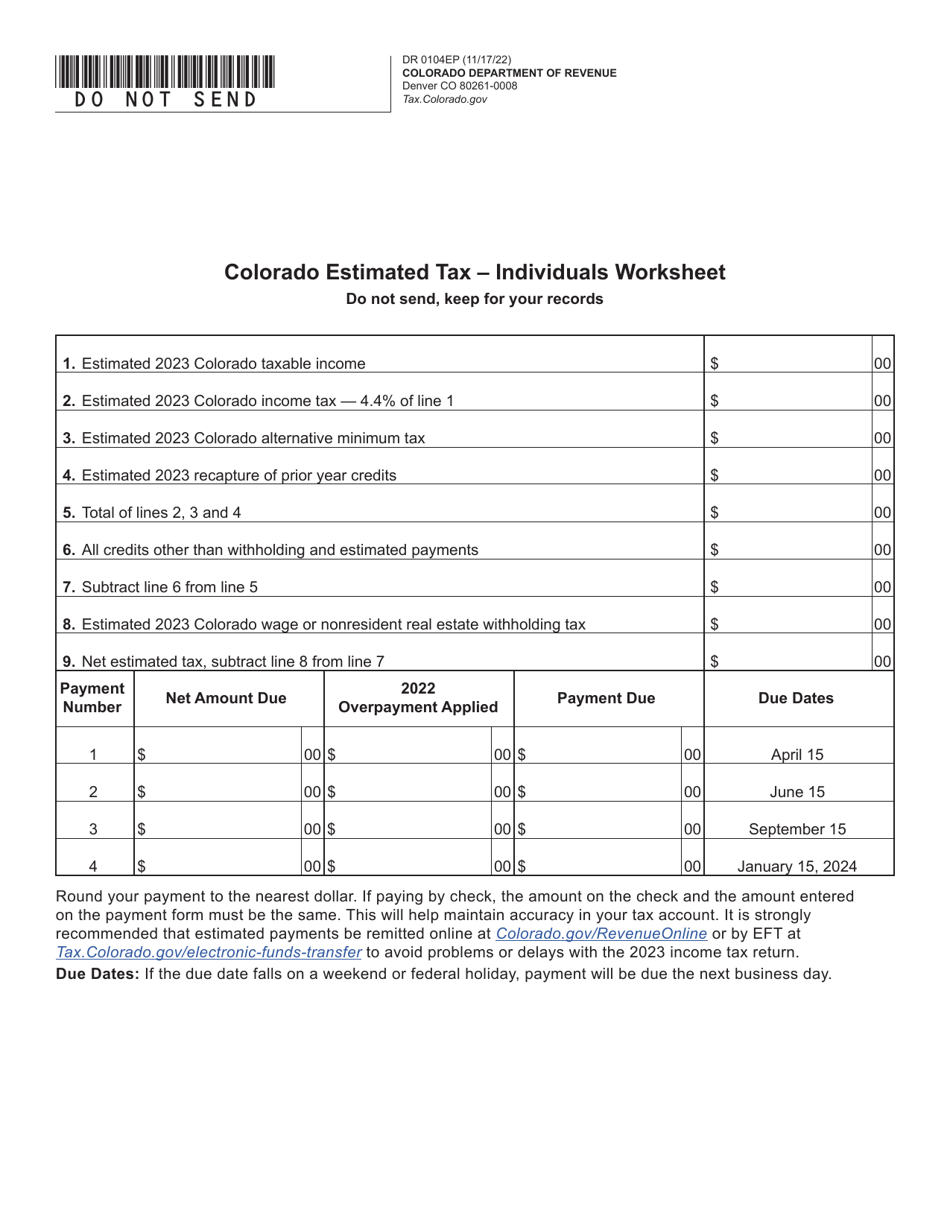

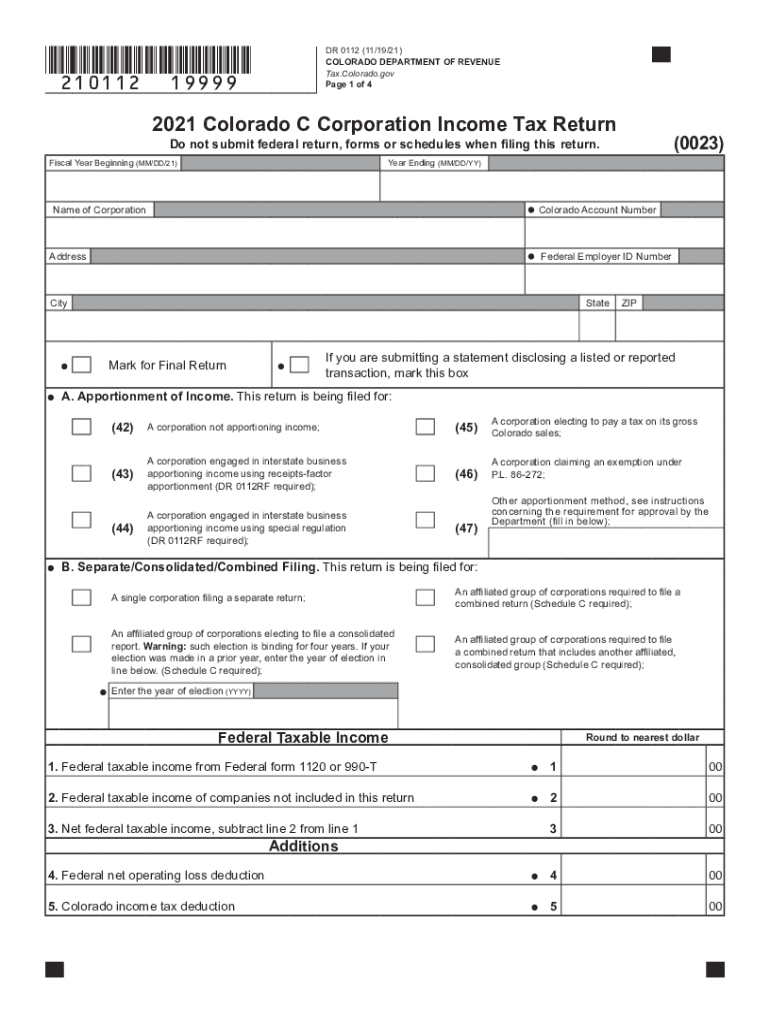

Form DR0104EP Download Fillable PDF Or Fill Online Colorado Estimated

Form DR0104EP Download Fillable PDF Or Fill Online Colorado Estimated

Colorado State Taxes 2024 Dawn Mollee

Colorado State Taxes 2024 Dawn Mollee

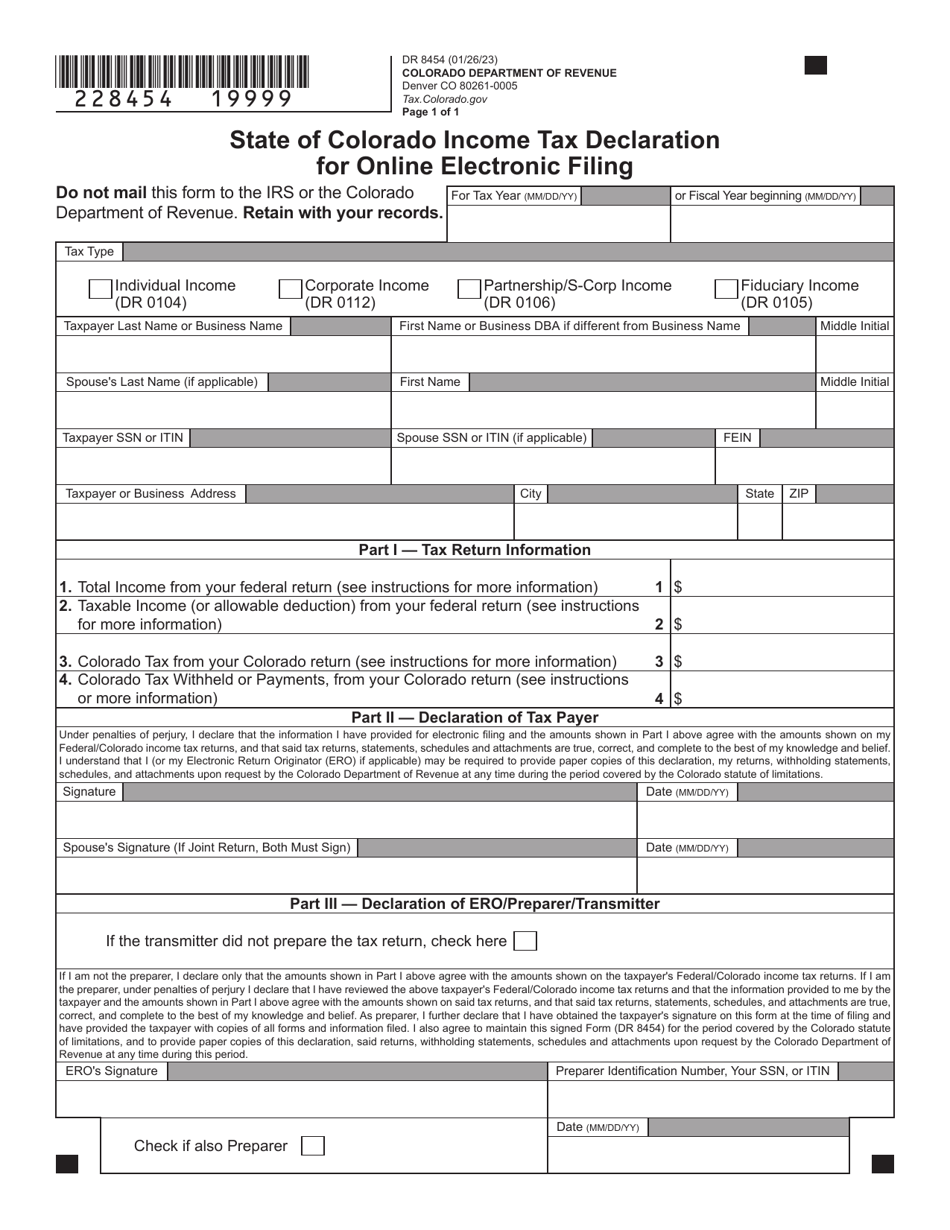

Form DR8454 Fill Out Sign Online And Download Fillable PDF Colorado

Form DR8454 Fill Out Sign Online And Download Fillable PDF Colorado

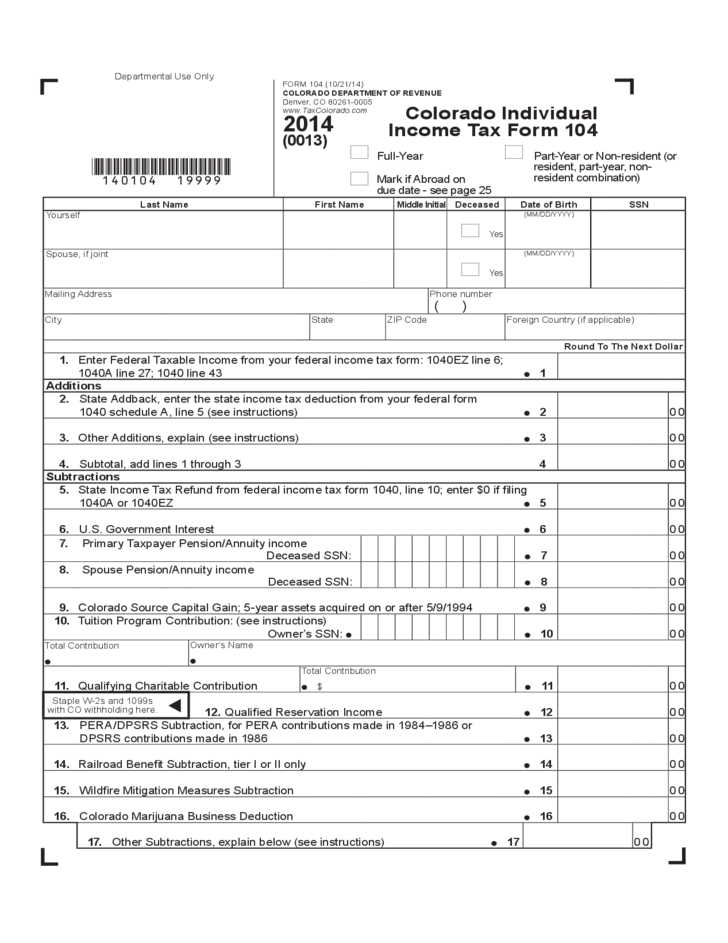

Colorado State Income Tax Fill Out Sign Online DocHub

Colorado State Income Tax Fill Out Sign Online DocHub

When filling out the Colorado State Tax Form, taxpayers are required to provide information such as their income, deductions, and credits. It is important to double-check all entries to avoid errors that could lead to penalties or delays in processing.

One key aspect of the Colorado State Tax Form is the calculation of taxable income. This includes wages, business income, rental income, and other sources of income. Deductions and credits can help reduce the taxable income, ultimately lowering the amount of tax owed.

Once the Colorado State Tax Form is completed, taxpayers must submit it by the deadline, usually April 15th. Filing electronically is recommended for faster processing and confirmation of receipt. Taxpayers can also opt to pay any taxes owed online or by mail.

In conclusion, the Colorado State Tax Form is a necessary document for residents to report their income and fulfill their state tax obligations. By understanding the form and following instructions carefully, taxpayers can ensure compliance with state tax laws and avoid penalties. Filing taxes may seem overwhelming, but with the right resources and assistance, it can be a manageable task.