When you earn income from foreign sources, it’s important to understand the tax implications that come with it. In order to report this income to the IRS, you will need to fill out a Foreign Income Tax Form. This form allows you to declare any income earned outside of the United States and ensure that you are in compliance with the tax laws.

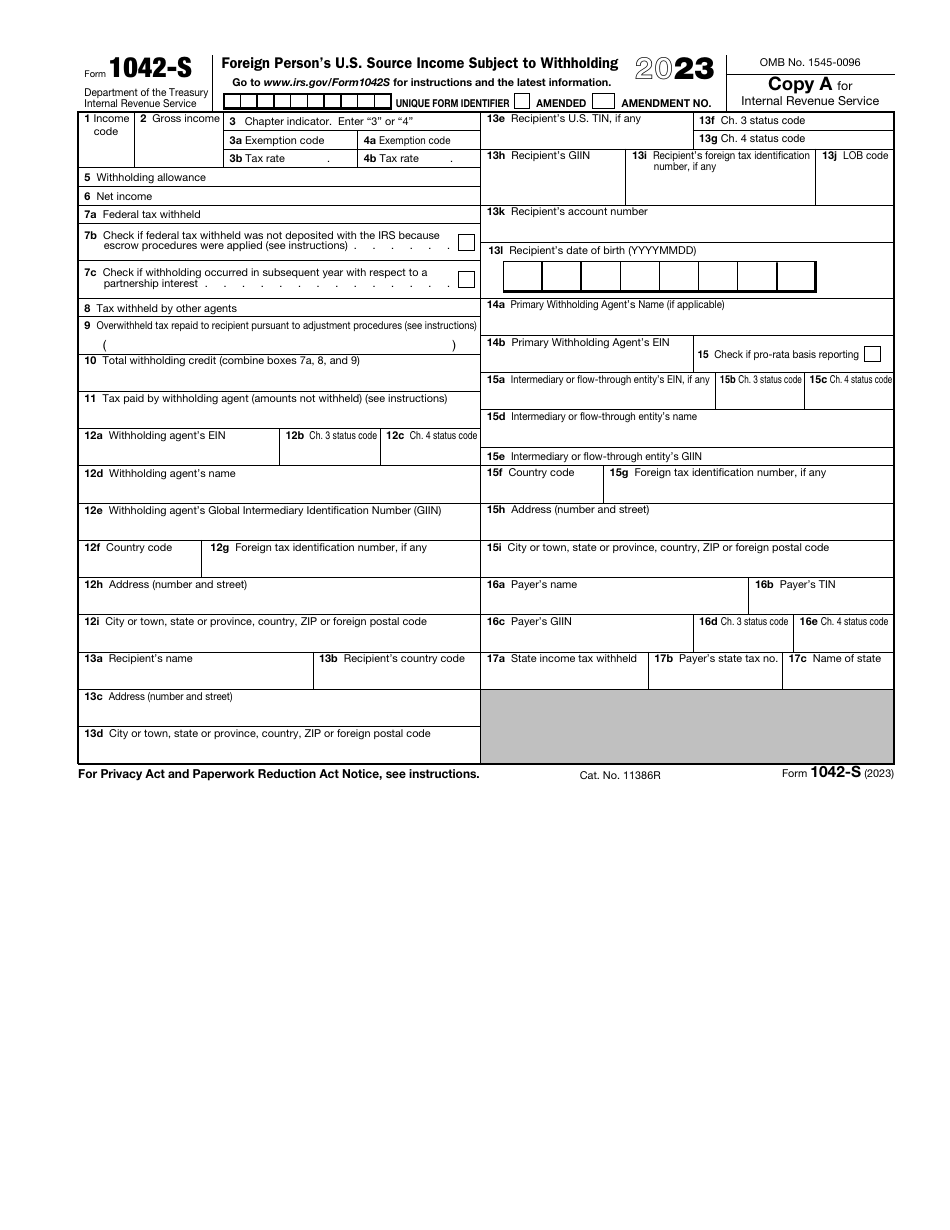

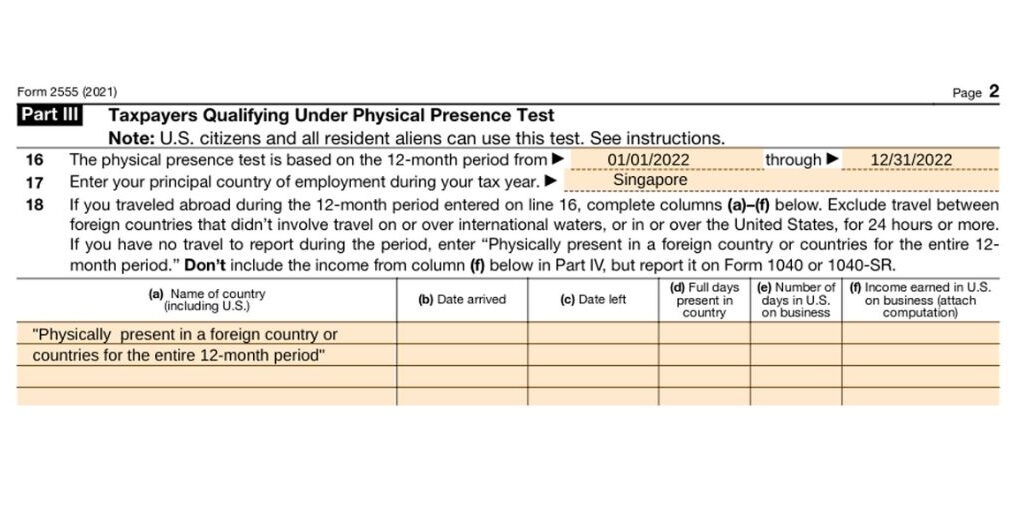

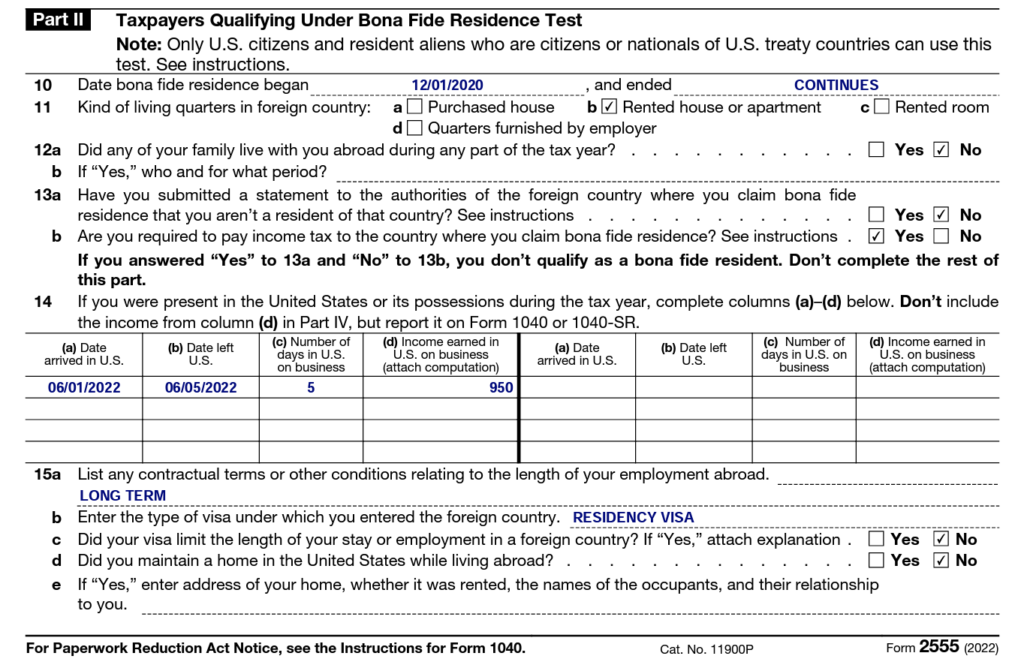

There are different types of Foreign Income Tax Forms, depending on the nature of your foreign income. Some common forms include Form 2555 for foreign earned income exclusion and Form 1116 for foreign tax credit. It’s important to determine which form is applicable to your situation and fill it out accurately to avoid any penalties or audits from the IRS.

Foreign Income Tax Form

Looking for an efficient way to manage paperwork? A free printable form is a great option for both personal and office use. Whether you’re handling employment forms, health documents, invoices, or permission slips, form printable help save time with ease.

A printable form allows you to complete important information manually or on a computer before printing. It’s perfect for workplaces, schools, and remote work where documentation needs to be organized, consistent, and ready to go.

Quickly Access and Print Foreign Income Tax Form

You can quickly find free, customizable templates online in formats like gift no design skills or software required. Just download, complete, and print as many copies as needed.

Take control of your routine processes and avoid wasted time. Choose a reliable printable form today and stay organized, focused, and in control—whether at your house or at the office.

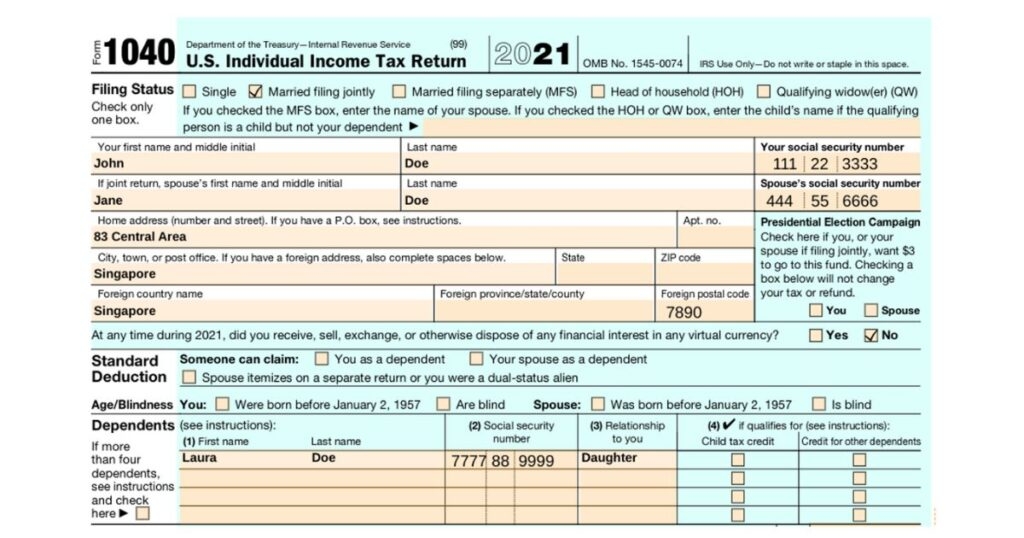

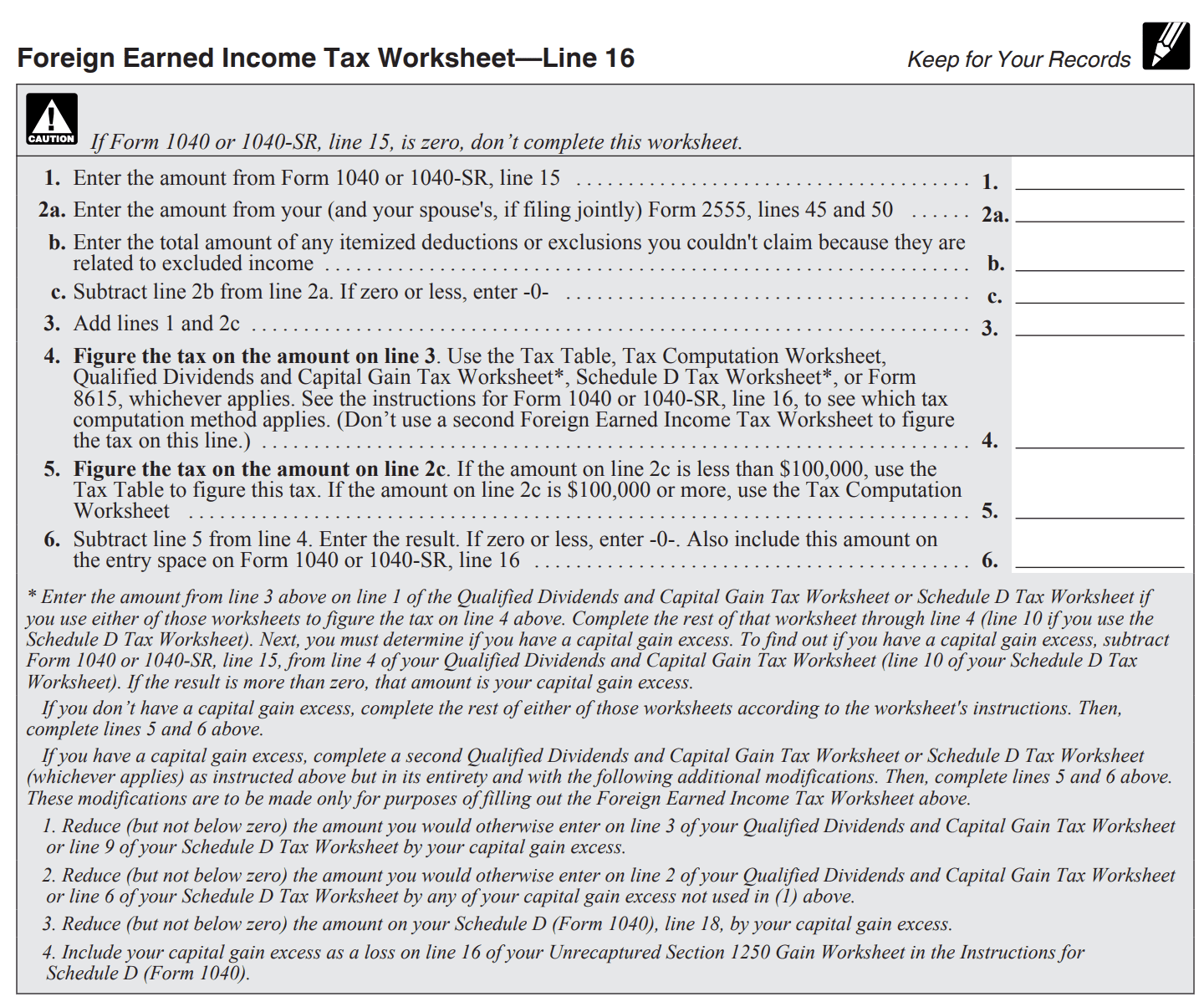

How To Complete Form 1040 With Foreign Earned Income

How To Complete Form 1040 With Foreign Earned Income

How To Complete Form 1040 With Foreign Earned Income

How To Complete Form 1040 With Foreign Earned Income

Filing Form 2555 For The Foreign Earned Income Exclusion

Filing Form 2555 For The Foreign Earned Income Exclusion

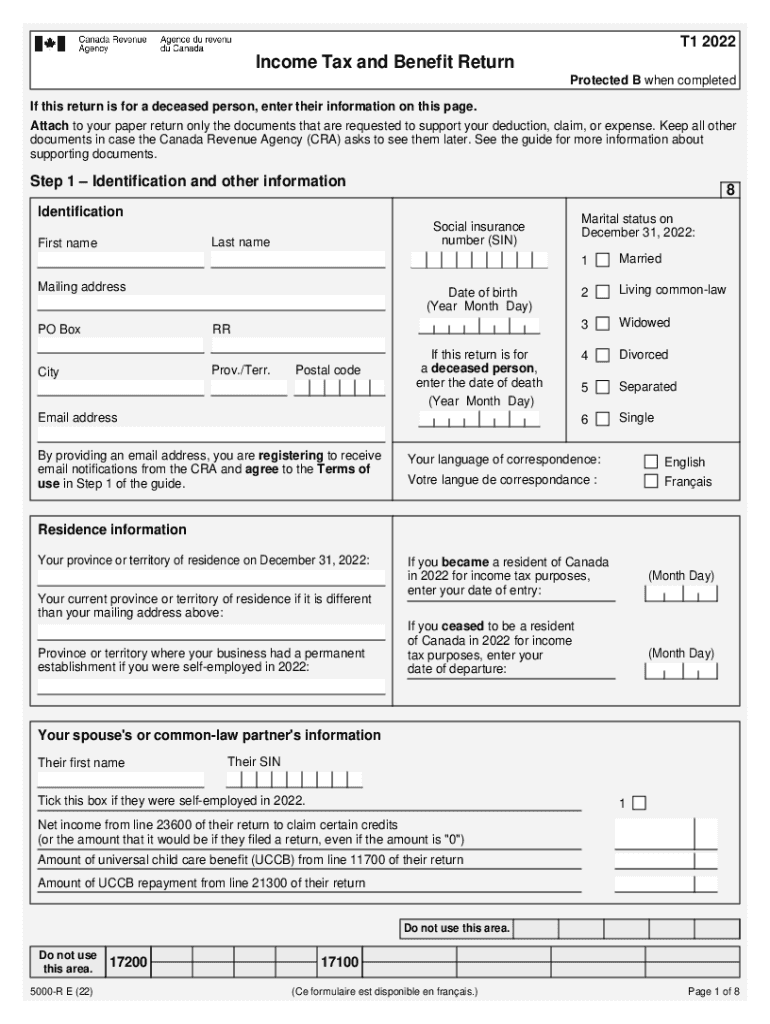

T1135 Foreign Income Verification Statement Fill Out Sign Online

T1135 Foreign Income Verification Statement Fill Out Sign Online

IRS Form 2555 A Foreign Earned Income Guide

IRS Form 2555 A Foreign Earned Income Guide

Foreign Income Tax Form

One of the most commonly used forms for reporting foreign income is Form 2555. This form allows you to exclude a certain amount of foreign earned income from your taxable income. To qualify for this exclusion, you must meet specific criteria such as living abroad for a certain period of time or having a tax home in a foreign country.

Another important form is Form 1116, which is used to claim a foreign tax credit. This credit allows you to offset any taxes paid to a foreign government on your foreign income against your US tax liability. By claiming this credit, you can avoid double taxation on your foreign income and reduce your overall tax burden.

It’s crucial to fill out these forms accurately and submit them along with your regular tax return to the IRS. Failure to report foreign income can result in penalties, fines, and even criminal charges. By staying compliant with the tax laws and properly documenting your foreign income, you can avoid any potential legal issues and ensure that you are fulfilling your tax obligations.

In conclusion, understanding and properly reporting foreign income on your tax return is essential for staying in compliance with the IRS. By filling out the appropriate Foreign Income Tax Form, such as Form 2555 or Form 1116, you can accurately report your foreign income and avoid any potential tax issues. Make sure to seek guidance from a tax professional if you have any questions or concerns about reporting foreign income on your tax return.